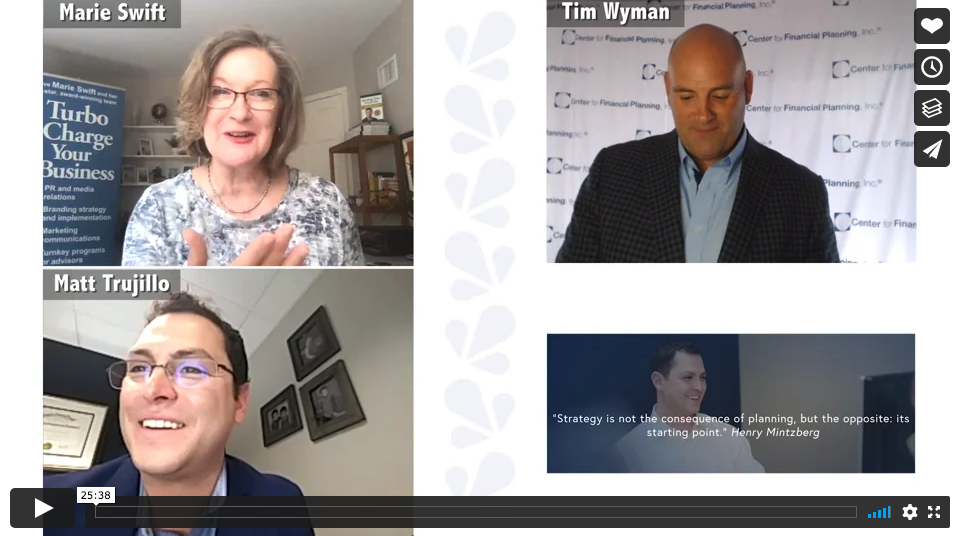

Swift Chat with Tim Wyman and Matt Trujillo: Succession Planning Tips for Financial Advisors4/6/2021

Impact Communications, speaks with Tim Wyman, CFP, JD, and Matt Trujillo, CFP, partners, Center for Financial Planning, Inc. They talk about internal succession planning for financial advisors and how the 35-year-old firm creates career paths and partnership opportunities for next generation talent. They also offer "tuck-in" opportunities for advisors with an established book of business who are tired of working on their own and would like to be a part of something bigger.

Watch this 25:38 minute video to learn about this client-centered financial planning firm. To learn more about the firm, please visit: CenterFinPlan.com

Watch the Video Now

|

About

|

|

Stay Connected

|

Phone: 913-649-5009

©2023 Impact Communications, Inc.

|