|

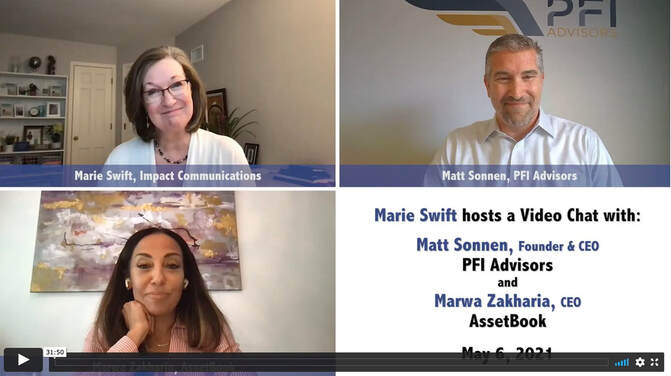

In this Swift Chat video conversation, I speak with Marwa Zakharia, CEO of AssetBook, and Matt Sonnen, CEO of PFI Advisors. Marwa, Matt and I have so many common interests -- and you'll learn all about them and pick up some golden nuggets to help you run a better financial advisory business in this 3-person Swift Chat.

It's truly amazing what our industry was able to do and we were all very lucky that our industry translated to virtual fairly easily. We got through that and now it's a little bit like the dog that caught the station wagon." ~ Matt Sonnen, PFI Advisors

Marie Swift: Hello everybody and welcome back to another Swift Chat. I'm your host Marie Swift. Today I am joined by Marwa Zakharia from AssetBook and she is the CEO. AssetBook is a portfolio management and reporting solution for independent advisors. Also, we have Matt Sonnen and he is the CEO of PFI Advisors, which is an operations and technology consulting firm.

I'm delighted to have you both here today, and you do have some interesting overlaps, but I want to start with you, Matt, and just get a little bit about who you are and hear about your backstory. How did you get to be the CEO of PFI advisors?

Matt Sonnen: Thank you for having me. I joke everyone says, what does PFI advisors do? I say, well, our mission is really just to continue Mark Tibergien’s messaging for all those years. All about the professionalization of our industry. This evolution of practices to businesses that has been going on for quite some time now. I don't have the large platform that Mark does, and I'm clearly not as eloquent as mark is, but I do believe RIA owners are looking for help with the business side of their organizations.

I think that they've figured out the client service side. They're great advisors, but many of them struggle with the nuances of being business owners. We work with advisors in a couple of different ways. We help advisors that are in the wire house or IBD channel, we'll help them come over and start an RIA from scratch. So in many ways, we're showing them how to be business owners for the very first time. We also work with RIAs that want to grow inorganically, but they don't feel they are scalable or efficiently run today. They're worried that if they don't clean up their back-office systems and processes, they will have a hard time attracting advisors to their firm. We recently released a white paper with Pershing on the topic. As sellers are evaluating all the different buyers that are out there today, they need proof that the buyer is going to allow them to grow faster as part of that organization, as opposed to if they were to keep plodding along on their own, or if they were to join another RIA. We work with those buyers to offer the most scalable and efficient platform for sellers to join and then we also work with existing RIAs, either on a project basis or retainer basis. We help them think through their technology and their people and their processes, all with the goal of helping them run a more efficient and profitable business. Swift: Very interesting. I'm pleased to get to know you more because I've been kind of a Twitter fan for a number of years, and only recently have you and I gotten to talk via virtual meetings like this. So, it's just a pleasure to meet you. Marwa let's talk a little bit about AssetBook and your role as the CEO. Tell us about how you got to this place, your backstory, and a little bit about AssetBook. Marwa Zakharia: Sure. Thanks, Marie. Thank you for having me it's a pleasure to speak with you and Matt. My back story, well, I was born and raised in Delaware which I think now people are actually familiar with what Delaware is or where it is, but most people know it as the drive-through state the first state, but my background is human resources and that's what I've spent the majority of my career, a little over 20 years now in the financial industries and FinTech. The glue that came about to coming to AssetBook is because I was actually contacted. They had some HR projects and operational issues that they needed some assistance with, and I wanted to work with them. Shortly thereafter, I was offered the position of COO. Started working on additional projects and as you know, with most small companies, there is more work than there ever is time. So, the management and board got together and decided that there was a re-org that was necessary, and I was then offered the CEO position and that was because they wanted to realize AssetBook’s growth potential. So, here I am today. PULSE BY ASSETBOOK Swift: There’s a brand new platform at AssetBook. Do you want to talk a little bit about Pulse and that big reveal that you had last fall? Zakharia: Of course I do. Everything Pulse related. So, Pulse is our new baby. It is the portfolio management monitoring solution that we have today. It has truly been what has moved us to the next level. Historically speaking AssetBook has served these small to mid-sized RIAs. We have stayed in that bubble, if you will, where pulse has positioned us now that we are able to still work with those startup RIAs, small to mid-size, but we're also able to work with the larger firms as well, and still be able to offer top notch client service, which is the reputation that AssetBook has come to establish. We're very proud of that. Swift: You should be. I know that Bob Veres and Joel Bruckenstein have written some very good reviews of Pulse. That caught my eye last fall, as we were just kind of going through the winter doldrums through the COVID lockdown and good for you guys to continue to innovate and roll that out and I mean, what better time? Advisers and RIAs really need the innovation right now. Right? Zakharia: Right. Yeah, we've had a lot of great feedback and it was something that we, you know, again, from a marketing perspective and you know, you hadn't heard too much, no one had, and that's where we were. We needed to grow in that area of just being known. We were working behind the scenes and we spent a lot of our resources on the development aspect of it, but now we are also allocating resources and time and efforts to get out there and just let everyone know that we are available and we have a new solution that will work for a lot more than just the startups. FALL CONFERENCE SEASON Swift: Speaking of getting out there… conferences, you know, the fog is lifting. It looks like we can travel and get together again, fingers crossed that we can all get together this fall. So Marwa let's find out where you're going to be with your team this fall and then Matt, same question for you. So Marwa. Zakharia: We're very excited about that human interaction is something we're very much looking forward to. Now that the CDC has been forecasting and announcing that the COVID cases are finally declining and there's an increase in the vaccines so that's been very promising. We have made the decision that we are going to attend, what we have on our radar right now, is three conferences. Joel Bruckenstein's T3, that’s one that we have historically attended year after year. It is a place that we find that's our opportunity to hobnob with our connections that we work with, our counterparts in the industry Get to know what they're doing, what they've been doing, and you know, just see what they've been up to. That's one that we will go to, it’s end of September the 27th through October 1st and that's in Denton, Texas so bring your cowboy boots if you plan on attending, we'd love to see you there. The next one on our radar is Bob Veres’ Insider's Forum, which is October 6th through the 8th and that's in Nashville, Tennessee. We always get valuable insight from both the attendees and from Bob, from what Bob publishes for us. So, we're planning on attending that and I've never been to Tennessee, to be honest with you, so one more incentive to get out there. Then we are planning on attending ACP, that is the Alliance of Comprehensive Planners and that is also in October. The 25th through the 28th in Atlanta, Georgia. I think it's very important that we have geographic diversity, it's exposure to a network that we may or may not have connected with and it’s always a plus for us so we're very excited. Swift: I'm going to be at all three of those, Matt, where do you fit in? Where are you going to be this fall so we can meet up. WORKING WITH SPOUSES Sonnen: We were a presenter at Bob Veres' conference virtually last October, which was great. It's so funny, Larissa, my wife and business partner, she can attest to it. I had a full-on panic attack last March when they said everybody's got to stay indoors. I said, Reese as a kid, I couldn't stay home from school. Like if I stayed home sick one day by 5:00 PM the walls started caving in, I was claustrophobic. At this point we were just thinking all this is only going to be a couple of weeks. We have to stay home. I said, I don't know what I'm going to do if I can't go to the office every single day. You fast forward 13 months and I know I'm crazy, I'm one of the only people saying this, but not for safety reasons I don't know if I'm going to leave my house ever again. This has worked out okay for us. Our industry has done great, we each have our own little area of the house. I'm locked in here. I'm on calls all day. I don't run into Reese or Luke during the day, other than running down to get water or coffee. Reese has her desk set up in another room. So we still at the end of the day sit down at dinner and say, Hey, how was your day? What'd you do today? We don't really interact throughout the day, so this little experiment has worked out so far. I mean, I'm joking. I'm obviously going to get out there, but as of right now I don't have any plans. We're just laying low and this is working for now. Swift: Well, you know, that's interesting. I have a little bit of it. I think it's called agoraphobia. Like you've been away so long. It's like, Ooh, is it safe to go out? But you know, Marwa, it reminds me that you actually work with your spouse too. And I work with my spouse, so we all have that in common. Talk a little bit about your spouse, Miguel. Zakharia: Okay. So, Miguel is actually the CTO of the company and how I became familiar with AssetBook. Holding a spouse role before any other professional role, you know, you have to ask questions. So, holding my spouse role, I'm at dinner, asking about asset book, then how the day goes and as I get the HR side of me and the operational management side of me starts to delve deeper. The last thing he wants to talk about is work and I want to talk about AssetBook more and more. It became a very interesting dynamic and we're polar opposites. He is very much a tech guy and if anyone knows what that means, he's very much in the trenches when I walked by his computer screen, it looks like gibberish to me, it's all numbers and things that I would never understand and vice versa. I am a people person and I want to work on strategy and moving the company forward and what we're doing next, and I want to do it yesterday. Sometimes my energy probably overwhelms him more than he cares to admit, but we complement each other so it works. It's a good setup. Swift: Interesting. So, my spouse had a big career in software and human capital, working for software companies, healthcare software, and then he took a buy-out package and sat around for a couple of years, and I said, you know you're too young to retire. So now he works for me in the family business. We know who drives that here today at Impact Communications, it's me, but I'm so delighted to have such a good life partner and a good business partner, because he really knows how to manage the numbers. MANAGING A COMPANY Let's talk a little bit about managing a company and there's a lot as CEOs that we all have to think about and manage and then as we work with our clients. So technology, operations, the people, the marketing. Matt. Let's have you go first on this? How are you thinking about that for PFI? Sonnen: It’s an interesting question. I mean, we're an operations and technology company, but I'm finding myself more and more reminding everyone, hey we're in a human industry. I think that so many advisors, we’ll get the phone call a lot where advisors say, Hey, just tell me what CRM to go buy. You're the expert. I just cut to the chase. They’re leading with the technology, and I say, this is going to confuse you because again, I'm an operations and technology consultant, but let's start with marketing, and they say, well I've got plenty of people I can talk to about marketing. I said, no, I can't tell you what tech stack to choose until we understand who your ideal client is. Who are you going after? Who are you looking to serve and how do you plan to serve them profitably? There is no one size fits all trading and rebalancing tool. One size fits all financial planning tool. I have to know who your client is and if you're going after a hundred-million-dollar household versus a hundred-thousand-dollar household, we need to understand all of that then we can back into the technology. So even for PFI, I've always started with who's the end client that we're going after, and then we'll sort of back into it from there. I always start, even though we're a technology consultant, I always start with the end client in mind, and then we work backwards from there. Zakharia: We're working on it, Matt. I'll solve that problem for you soon, soon enough. Miguel is going to kill me if he hears me say that and it's recorded, so. Swift: How do you think about that? The whole dynamic of running AssetBook Marwa? Zakharia: That's a loaded, interesting question. I think that what drove me the most to AssetBook are the, actually I can tell you hands down, it’s all of the human beings behind it. The staff hands down are amazing. They're the most loyal, knowledgeable, they were in the foundation of this company. I can't say enough great things about them. I am a very fortunate individual to be in this position. We have a very cohesive team environment that we work in. Everyone feels that they're included, we make decisions together it's not one sided. We've grown significantly but it truly was a huge decision factor for me. Maybe it's because the core of me is HR, but I've always loved the idea of helping individuals and helping them grow. The leadership side that's foundationally in order to have a strong business, you have to have strong individuals behind that. AssetBook is that which is why we have great customer service, our clients, I believe can attest to that. I just received amazing feedback again yesterday. That really solidifies what we're doing and we're going to continue to do better. We're actually hiring, we're continuing to hire, we're growing. Anyone who knows anyone that or would love to join the AssetBook team I would love to have you. I'll say email your resume to [email protected], we are constantly hiring, open to looking at resumes, having a conversation with you. We want to continue to grow and we're growing quickly. ADVISOR SENTIMENT Swift: It’s interesting. One of the observations I have about moving through the pandemic is everybody just seems a little bit more human and more kind, at least the people around me. I know that that's not true universally, but I've been so blessed. We've set a new standard for family dinners at the Swift house. We never used to sit down and eat together this much, but I've gotten to know my daughter’s boyfriend because he eats with us almost every night and we sit down at the table, and we have meaningful conversations. I know I'm getting just a little bit off topic, but if you'll humor me, I did this study called Conversations That Matter in partnership with Allianz Life Insurance Company of North America and their RIA Advisory Solutions Group at the end of 2020 to find out how advisors were doing and how their clients were doing and what made the difference for advisorswho are not just paddling along and surviving, but the ones that actually were thriving and gaining market share. What we found is that the human conversations, that more deep, meaningful conversation is what made the difference. It endeared them to their clients in a different kind of way. Even like going above and beyond and helping people understand how to order, if they didn't know how to do Door Dash or something or helping get the essentials like hand sanitizer and toilet paper, you know, the advisors that I spoke with and the 342 that came into the survey, told me stories about that. And so, it really just is exciting for me to have been through this year of virtual reality. Of course, we were all kind of in that maloo anyway, but now getting to see each other again, but I think we're all better for the challenges that we have. So, Marwa, I want to go back to you because I know that you're tuned into advisor's sentiment as well and Matt, you are as well, but Marwa, let's hear from you first. What are you hearing from your current and prospective subscribers? Zakharia: In our conversations with advisors, we find that across the board they want best-in-class solutions. Advisors really appreciate the ability to tailor their tech stack exactly to their needs rather than paying for a lot that they may or may not use. Pulse was built with the best-in-class strategy in mind. We are constantly innovating, adding new features, we're working on new integrations for that very reason. We recently spoke to a prospect who likened paying for a bespoke suit as opposed to grabbing something off the rack -- one's a better experience than the other. Pulse was built with the best-in-class strategy in mind. We are constantly innovating, adding new features, and working on new integrations for that very reason. Swift: Matt, how about you? What are you hearing advisor sentiment and then were you seeing any kind of panic or frantic phone calls are around purchases, mergers, acquisitions. What was that like going through 2020 and now emerging through 2021? Sonnen: It's been amazing. Every everyone's saying "I had a record year and 2021 is looking great, too." It's truly amazing what our industry was able to do and we were all very lucky that our industry translated to virtual fairly easily. On the M&A front, you see the headlines every day, there's four, five, six. There's just so many mergers. We, we do get frantic calls every once in a while from a buyer that says we were so focused on getting the ink on the contract. We had to get through those difficult conversations around investment philosophy and culture and deal structure and of course valuation, but we were just focused on the deal. We got through that and now it's a little bit like the dog caught the station wagon. Now we don't know what to do. So, they call us up and they say, "How are we going to get the synergies that we built into the model? How are we going to get those? We're using this set of systems and they're using this set of systems and we didn't even think this far ahead. Can PFI help us think through what should the tech stack be of the combined firm? What should the processes be, the workflows?" Once we've made those decisions, can you help train the staff of both firms, because both are going to go through some changes through this and help train them on again what are the workflows and processes and technology of this new firm going forward? Swift: Really interesting. Well, is there anything in closing before I asked my one bonus question? Anything that you wish you'd said that you'd like to say now, Matt, you go first. Sonnen: No, I just, I really appreciate the opportunity. Geez. I've been in the industry for a while now, 1997 and I feel like in the late nineties it was, everything was going straight up. We've never seen a market like this. Then you had 2000, the crash and everything else. Now we were going through pandemics. It feels like every year we say, boy, we'll never see a year like we just went through, but the industry just continues to grow the independent space is fantastic. It's money's piling in, but it still stays a very small tight-knit community. I just, I'm so excited about our industry in the future. Swift: Marwa any golden nuggets? Zakharia: Not that I can necessarily share at the moment, Marie, you're probably privy to that information more than anyone. We do have some exciting integrations on the horizon. WealthBox was announced via our newsletter, so I can share that, but we do have some exciting features, integrations and other things I cannot mention. I'm going to call them things at the moment, but this year is a good one. It's definitely a good one. We will have a good splash for 2021 for AssetBook to be mentioned. Swift: Speaking of splashes, T3 came out yesterday and announced that ScratchWorks, the ScratchWorks competition is going to be on the Thursday during that big T3 week in Denton, Texas. I know we're all really excited about that. It'll be three finalist’s startup companies or early-stage technology companies pitching their solution to a panel, kind of like shark tank, where those people on the panel could offer money and deals in return for equity and sit on the advisory board and help those firms grow. I believe this is the fourth year that the ScratchWorks competition is taking place. We're just delighted for Joel Bruckenstein and T3 that ScratchWorks has chosen T3 this year. It used to be at the Barron's Top Independent Advisors Conference so that's pretty cool. And Yeah, I think I'll wear my cowboy boots to Nashville too. You know, if you're going to invest in cowboy boots you might as well wear them where you can. HUMAN INTERESTS Swift: In closing here's my bonus question and let's go with Marwa first and then Matt. I'd like to know about what drives you as a human being, as an individual, your passions, and maybe some of the charitable organizations or volunteer work that you do. Zakharia: If you want to wrap up this call, two things that you shouldn't ask me about our human capital or volunteer work, because I could keep you on here for another 20 to 30 minutes, but I'll try to keep this short. I do have a soft spot for volunteering and nonprofits. I sit on a board of directors for, the acronym is CCAC, which stands for Christina Cultural Arts Center. They have been around since 1906. I'm probably saying that wrong, but they've been around for a very long time. They were established in Delaware and it's more than just the arts. They target more of the groups that are in need and in difficult situations. It's open to everyone, but there's an educational aspect and it has truly helped children throughout the pandemic. I think that a lot of individuals have taken for granted how much it has impacted, I mean, it's impacted all of us as adults. You can only be behind closed doors for so long. Like Matt mentioned earlier, can't hold me in captivity for too long because you want to climb the walls. So, for children, statistically, it has been very difficult for kids to get acclimated in the wintertime. There's been a lot of kids that have been through depression. This program and center has been truly something that has helped a lot of children navigate through a lot of hard times and along with that they've just helped, as a society, they do toys for tots. So, we do a lot of things that touch every aspect of volunteer. Children, adults come in, you know, the dance aspect, it's just motivational. It's kept them out of the streets. Homeless shelters are something I did with my son from a very young age. Sunday Breakfast Mission is one that we do in Philly. Animal shelters. We are huge animal lovers and that's another one that my son and I would do together since he was very young and we've stuck with it. We volunteer at the local SPCA. We donate to the humane society. Like I said, I could talk about this for hours because you know, women, children, animals, pretty much anything, you know, you'll get me. We did meals on wheels all throughout the pandemic because it's just something, you know, we'll just jump in. It's a feel good and helping people. That's what it's all about. Swift: Yeah, for sure, Matt? Sonnen: My first foray into volunteer work, I was a volunteer via Big Brothers for eight years until my little brother, he moved to Louisiana to be with his dad, but he was six years old when we were first matched and then he moved away when he was 14 so we were together every weekend for eight years, and then he just graduated college actually last year, which is just crazy to me. So that had a big impact on me. I was really starting to get involved with Big Brothers, Big Sisters of Los Angeles and then we wound up having kids of our own so that sort of derailed me a little bit. Unfortunately, our daughter got sick when she was six months old, and we basically lived at Children's Hospital Los Angeles for two years and they took amazing good care of her and of us. They treated us so well there. So, we raised a lot of money, we've tried to raise a lot of money for CHLA. One of the nurses’ stations on the five east wing is named in Layla's honor. We're very passionate about CHLA. The last month of her life, Trinity Kids Care Hospice took care of Layla here at the house and to this day, they're still taking care of me, Reese and Luke. Just from an emotional standpoint they helped us, Luke was three he was about to turn four when she passed away and they helped us sit down with Luke and explain what was going on. We had no idea how to have those conversations with a three-year-old. They're the only dedicated pediatric hospice program in Los Angeles and Orange County so we do a lot of fundraising for them. We've actually created, we call it Layla's walk. We created it with Trinity Kids and the stars have aligned. Actor Jack Black actually hosts it for us and he hosted it in person two years ago and then even last year, virtually, he was the emcee from his backyard. He just walked around in circles in his backyard and helped raise funds and awareness for that incredible organization. We'll be supporting CHLA and Trinity Kids for many years to come. Swift: Wow. Well, I feel like a slacker compared to the two of you. They're really beautiful moving stories, everything that you've shared. I live through my kids and my kids tend to take on things. I have a 30-year-old and a 22-year-old and so whatever they're doing means that mom and dad are also doing or supporting. So, right now we're supporting Global Dental clinics and they're feeding a lot of families and South America and Central America and not just doing dental work because well, the doctors and the dentist can't really travel so well down there. I'm also, I've been blessed to have someone in my life who has Down Syndrome and she is so beautiful and competent. So, I've been roped into helping mentor a group of young adults with Down Syndrome start their own businesses. That's just been a joy. Thank you both of you for being here with me today. It's just been a wonderful, delightful 30 minutes. Zakharia: Thank you for having us. Swift: Thank you. All right, we'll see you around this fall. Zakharia: If we can get Matt out of the house. Swift: Let's work on that. We'll work on it. And with that, we'll say goodbye. In our conversations with advisors we find that across the board they want best-in-class solutions. Advisors really appreciate the ability to tailor their tech stack exactly to their needs rather than paying for a lot that they may or may not use. Pulse was built with the best-in-class strategy in mind. We are constantly innovating, adding new features, and working on new integrations for that very reason." ~ Marwa Zakharia, CEO, AssetBook Comments are closed.

|

About

|

|

Stay Connected

|

Phone: 913-649-5009

©2023 Impact Communications, Inc.

|