|

In this special Swift Chat podcast episode, Marie Swift interviews a range of guests from the Investments & Wealth Institute ACE Academy 2022 conference including:

- Jeffrey "the Buckinghammer" Levine, Chief Planning Officer of Buckingham Strategic Partners

- Stephen Resch, Vice President, Retirement Strategies Division / Advisor Educator for Finance of America Reverse - Dan Wanous, Business Development Officer of Thrivent Advisor Network - Anthony Mlachnik, Advisor at NorthRock Partners - Roger Ibbotson, Professor at Yale School of Management and Chief Investment Officer at Zebra Capital - Jess Flynn, Communications Director for FP Transitions - Ray Sclafani, Founder and CEO of Client Wise - Mark Paulson, Global Hedging Business Development at Allianz Life Insurance of North America - Tim Whiting, Chief Revenue Officer and Managing Director of Sales of IWI (Investments & Wealth Institute) All are shown in order of appearance. There are soooooo many great insights in this "recorded live at a conference" episode. Listen in! This is a people business. This is a trust business. You need to build trust with folks. And one of the best ways to do that is to show who you are, right? ~Tim Whiting, IWI (Investments & Wealth Institute) Transcript of Conference Conversations - BelowSpecial Thanks to Allianz Life Insurance of North America and the Investments & Wealth Institute

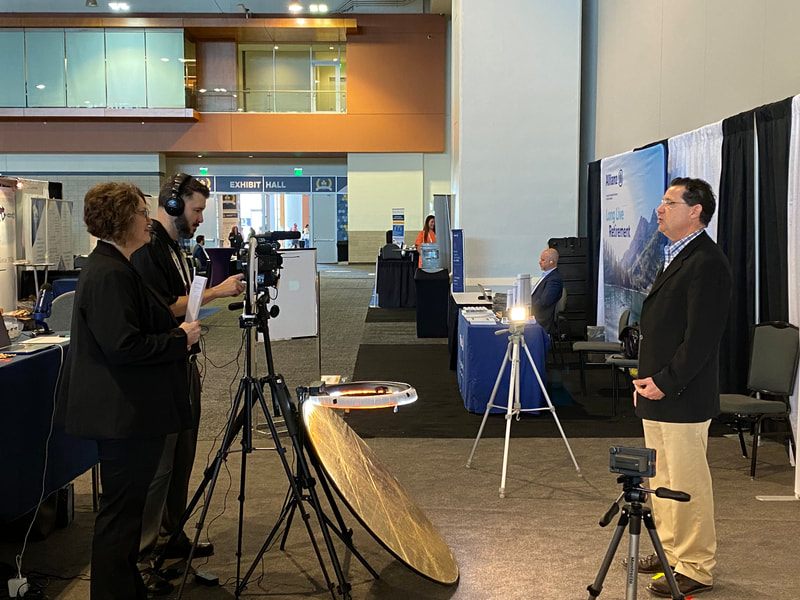

Impact Communications loves spending time with financial advisors and other conference attendees. One of our favorite things is to create an experiential learning center right in the middle of an exhibit hall. This creates a bit of an oasis for attendees who may not otherwise make their way through to the middle and/or back of the exhibit hall. Conference organizers who (a) place the "oasis" in a strategic position in the hall and (b) promote the opportunity to come and pick our brains, experiment with audio/video gadgets and gizmos, etc. see higher foot traffic in the hall, thus making the sponsors happier -- and attendees, too.

The Digital Hive 2022 at the Investment & Wealth Institute's ACE Academy was powered by Impact Communications, Inc.'s group programs division and sponsored by Allianz Life Insurance of North America's Financial Professionals Division. Scenes from the Digital Hive 2022 -- as well as a short "announcement video" as to who won the grand prize via the drawing -- are below. And the winner is ... drum roll please:Transcript of Digital Hive Podcast

GUEST #1: JEFF LEVINE

Marie Swift: We're live in Nashville. We're at the ACE Academy. I'm joined by Jeff Levine of Buckingham Strategic Partners. And Jeff, you've become known as "the Hammer" -- "the 'Buckinghammer." So tell us why that is. Jeff Levine: Well a few years ago when I made the transition over to Buckingham with Michael Kitces, we were trying to just create some interest and some excitement around it and see what silly type of thing we could do to draw attention. And so I changed my Twitter name to Jeff the Buckinghammer Levine, and it, it kind of stuck. And all of a sudden people started saying, "Hey Hammer, Hey Hammer." And it's continued on. So still to this day, I do a weekly segment with Bob Powell at Retirement Daily (part of TheStreet.com) that we call "Ask the Hammer" and it's just become kind of a thing. Swift: So you're here at the Academy talking about what? Levine: Using trusts as an IRA beneficiary. And when we say IRA here, really meaning for all sorts of retirement accounts. So a lot of times high net worth individuals have accumulated significant amounts in their IRAs, 401(k)s, 403(b)s, and they wanna make sure that it's passed and protected for the next generation. And so trusts are obvious vehicles for that at times. Swift: So this is one of the groups where I think the more sophisticated practitioners gather. There are advanced designations available through the Investments & Wealth Institute. So, just curious what you think about how this crowd may differ from other crowds. I know you go to a lot of events and conferences. Levine: I do. This group definitely asks really good questions. The type of question where it's not a first level question, but it's like, "I know the basics, but now tell me about what happens in a situation where there's this, this, this, and this unique exception," and you get those type of questions when people have a really solid understanding of the foundation. So that's always fun. And I also think that you get ... the typical advisor here is seeing clients that are a little bit more higher net worth. So you get those sorts of questions that are more geared towards the legacy for their future generations, as opposed to merely and not, I shouldn't say maybe just merely, but as opposed to the primary concern of most individuals, which is managing for their own retirement. Most of the advisors here are looking at least two generations deep. Swift: Fantastic. Well, you definitely need to know your stuff to speak to this audience. That is for sure. So I know you're gonna be hanging around the conference here, the academy for a while. What's next for you after this conference? Levine: Back to St. Louis to teach a three day course on advanced IRA planning. So always doing something in the education realm. Swift: Always doing something well, thank you so much for being here today. GUEST #2: STEVE RESCH Marie Swift: All right, we are back. And we are at the ACE Academy in Nashville. I am with Stephen Resch of Finance of America Reverse. And Steve, you're talking about reverse mortgages here in the context of a retirement plan and all the fresh modern tools and resources and products that advisors should be thinking about. So what's your Ed Talk about? Stephen Resch: Well, the Ed Talk is basically just educating about the reverse mortgage itself. I think a lot of advisors aren't really understanding how the program works. They view it mainly as a loan of last resort for people who have run out of money. And I'm trying to change the needle on that conversation and help explain how this is really a very viable retirement planning tool. It's the opportunity to bring home equity into a financial planning process. Which really hasn't been talked about much in the past. Swift: So one of the things as I've been reading up is about converting to Roth IRAs. And so talk about the dynamics right now, where the market's up and down. I think maybe it's down right now. So what are the opportunities when the market is down, whether it pertains to a Roth IRA or staying in the market with some other alternate source of income stream? Resch: Well, yeah, if the market isn't down now, it probably will be tomorrow. So this is really a great time to think about doing Roth conversions, because the value of IRAs are suppressed right now. And so if we do the Roth conversion at this point in time, obviously we're moving assets to a position where hopefully they will recover in an income tax free environment. What we've been doing with FAR is more and more Roth conversions funding the tax liabilities using home equity and it's worked out very well. It's quite a unique, interesting strategy because Roth conversion is really an ideal retirement planning tool for middle America. And yet this is the group that really doesn't have a lot of the liquidity available to pay the taxes on the conversion process. So this is a way to really help everyone out and get the job done. Swift: So I know that you're out on the conference circuit. I saw you at the FPA Retreat recently, where we had a group of advisors at a round table. That was great. And we're gonna be doing more of that when you and I happen to be in the same cities. And we're gonna kind of be like co-hosts, I guess you would call it for this thing. We're calling FAR Sight Advisor. So it's going to be advisor round tables where you and I are gonna talk to interesting advisors about what's going on in their world. So I'm excited about that. Resch: I am as well. I'm looking forward to it. Swift: So where's next for you? You're here in Nashville. Where you going next? Resch: Oh, there is another one in Nashville. And I can't remember the name of it. It's next month. There's so many conferences and I just have them on my calendar, but I can't always remember the names of them. I'm sorry. Swift: Steve, it's always nice to see you. Thanks for being here. GUEST #3: DAN WANOUS Marie Swift: So I'm here with Dan Wanous. And Dan, you're with Thrivent Advisor Network. And what are you doing here at the ACE Academy? Dan Wanous: Well, we are excited to talk more with advisors about how we help them build purposeful and productive businesses. And we're often asked what do we mean by purposeful businesses? That can, that can sound a little squishy and we've generally found that an advisor's 'why' so to speak changes over as they move throughout the business. And so early on in the career that 'why' can be something like, you know, "we help our clients make wise decisions around their most important financial elements of their life." And eventually they hire a team and they grow that team. And all of a sudden they have to build and manage a team in a business that is now helping clients. And so it's not just them delivering financial advice, but it's leading a financial advisory business. So all of a sudden there's these different 'why' questions around, how do we help our team members thrive? How do we recruit and attract a diverse team that's gonna stay engaged and really serve our clients well, and help us grow the business? Swift: So you're gonna be speaking at 12:20, I think, today on stewardship and business growth. Tell us a little bit about that. Wanous: Well, we found that advisors who, who really lean into these elements of purpose that engage most with their clients on a human level are able to thrive and build deeper relationships than those that just focus on kind of the tactical elements of how they manage the money. And so when they ground everything in those purpose elements or how to leave a legacy or things like that, it deepens the relationship substantially and enables them to, to build a business that their clients can be passionate about and that their team members can be passionate about. Swift: So have you been to the ACE Academy before? Wanous: This is my first time at ACE. Swift: And what do you think? Pretty exciting to be back in person. Wanous: It's been very exciting to be in person. The energy amongst the people that are here in the keynote sessions and the breakouts, just in the exhibit hall, it's been really fun to be back with a lot of people. Swift: Yeah. And it's a different kind of curriculum. This is a kind of educational experience that a lot of practitioners don't, or they're not privy to because this is a headier crowd, I guess, just because of the designations that the Institute confirms. So I'm looking forward to learning more about what your work with Thrivent is. And also I know that the Institute announced something interesting about, well, yesterday is really exciting about the foundation, so that now this will help forward their good work in helping people who are underrepresented in our profession, if you will, to get the credentials that they need. These advanced credentials, the three that the Institute offers. So I believe that Thrivent is making a donation to the foundation? Tell us more about that. Wanous: Well, just as we're talking about how advisors filter all of their decision-making through this lens of how does this align with our purpose? As we think about how, when we show up to conferences, when we engage with advisors we can, we can think about the dollars that we spend there and whether or not those are aligned with our purpose or whether they aren't. And this was an incredible opportunity for us to, to find IWI and some incredible work that you're doing to get underrepresented advisors access to more designations. And so it was something that we were really excited to be a partner with. Swift: You know, you say that you're not giving away booth tchotchkies but I'm actually wearing one of your booth tchotchkies, which is a wonderful blanket. I hear that this is a multipurpose blanket, shawl, cape, whatever you need it to be. And it's kind of cold here today. So I'm happy to model this. Wanous: Yes, it's an "if you know, you know" type of item, those that know what they are, are incredibly excited about them. And. It's been fun. Swift: So send me over to your booth. Bring me one of those Thrivent blanket/shawl/multipurpose/wonderful things, and drape me up! GUEST #4: ANTHONY MLACHNIK Marie Swift: All right. I am here with Anthony Mlachnik. Did I get that right? Anthony Mlachnik: It's okay. Mlachnik but you're not the first. Swift: All right. So your company is...? Mlachnik: NorthRock Partners. Swift: And you're in Chicago, right? All right. So you also have the CIMA designation. How long have you had that designation? Mlachnik: I do. Coming up on about eight years now. Swift: Okay. So what attracted you to the IWI? To the whole credential and the CIMA? Mlachnik: Yeah, I mean, just that curiosity and kind of always wanting to learn more and being able to bring certain techniques back to my clients. Swift: And so you work with a pretty well-heeled clientele, yes? Mlachnik: Yes, I do. Yeah. I'm very fortunate in the type of clients that I'm able to work with. And, you know, they challenge me every day and my team, and that's part of the reason why we come to events like this is so that we're always staying cutting edge and learning something new that we can put into practice. Swift: Fantastic. And it has to give you as well as the client, some great confidence to know that you have that more sophisticated base of knowledge. Mlachnik: It does. Absolutely. Yeah. Some, I mean, sometimes it's just carving time out, you know, of the busy days and weeks and months that we're all a part of and focusing a little bit more on the business versus oftentimes we get so entrenched in the business and it, absolutely. Swift: So here you are, you're working on the business, not in the business. You're here sharpening the saw, if you will, and what brought you to the conference and what stands out as some of the better content? Mlachnik: Yes. So far I've been attracted mostly to the business and practice development. What I've seen coming out of COVID is just that my people need me as a leader more than ever. And being able to hear what's working from other advisors or consultants has been a breath of fresh air and just new ideas that I can bring back to make sure that we're continuing to create a great experience for our clients. Not only for our clients, but also for the people that are involved at NorthRock Partners. Swift: Fantastic. Thanks for spending a little time at the mic with me. GUEST #5: ROGER IBBOTSON Marie Swift: So I'm joined now by professor Roger Ibbotson who needs no introduction. He is at the Yale School of Management and very popular with the crowd here at the Investments & Wealth Institute and also other academic gatherings of advisors. So you were here talking about popularity, a bridge between classical and behavioral finance, and you actually have a book about that same topic. So tell us in several bullet points, what we should know. Roger Ibbotson: Well, it really is simple because the title of the book is "Popularity," and it talks about liking things. Now it turns out though that if you like a stock too much, you push up the value of the stock. And that means that without changing the cash flows, the expected returns are low. The things we normally like are things like we like liquidity, but we don't like risk. We like brand recognition and things like that. But so I guess these are things we like, and there's certain things we don't like. But if we like, and we push up the price, if we don't like 'em, we push down the price. And so this is a general way of looking at everything, a general way of pricing all assets, actually. Swift: So when you talk about the bridge between classical and behavioral finance, what does that mean for a lay-person like me? Ibbotson: Well, in classical finance, we assume that everybody's rational. I'm not gonna say that's a person like you necessarily because the other behavioral finance assumes people are not completely rational, that they're emotional and make cognitive errors. And all of us, you and me, I think, are emotional at times. We're not necessarily rational. So we need a theory that is encompassing of both rational and irrational behavior. And that's classical and behavioral finance. Swift: Interesting. So how can we avoid being tripped up by some of these emotional and cognitive errors? Ibbotson: Well, you you avoid them by knowing a lot about this and ideally if you read the book and some of the other articles that I've written and so forth, if you take this perspective, that the popular stocks are not necessarily the best stocks to buy because they already have the higher prices. But typically that's how we do get tripped up because we tend to go for what's popular. We think we need a lot of liquidity, for example. Well, you need some liquidity, but not now as much as you have. And liquidity is expensive. If you can buy things sometimes that are a little less liquid, you can get better deals and you can get better prices and better returns. Swift: So in addition to teaching at the Yale School of Management, you're also a chairman of Zebra Capital. Tell us a little bit about that. Ibbotson: Yes. Zebra Capital has an investment company. It also has hedge funds and long and short equities. It has indices probably that's what we're most known for at the moment. We have indices that are used in the insurance industry, which create various insurance products. So basically to help people hedge, help people protect their retirement in various ways. So we're a firm that offers a lot of products that helps. Helps people with their investments and with their retirement. Swift: So curious, where do you live? Ibbotson: I live near Yale because I'm a Yale professor. So I live very near New Haven and it's a fine place to live. And I gotta say that I've enjoyed being at Yale over the years before that I was at the University of Chicago. That was a great place too. So I haven't lived everywhere, but I've certainly enjoyed where I've lived. Swift: Well, Professor Ibbotson, thank you so much for being here today. Ibbotson: Well, it's great talking to you. Thank you. GUEST #6: JESS FLYNN Marie Swift: So we're back and we're here in Nashville at the ACE Academy for the Investments & Wealth Institute. And I'm joined now by Jess Flynn. And Jess, you're the Director of Communications for FP Transitions and you and I go way back. Do you remember how many years we've known each other or where we first got to know each other? Jess Flynn: I think it was maybe 2010 or 11, maybe when we met? Long time ago, it was one of the ... you were one of the first females that I had met in the industry, probably. And I think it probably predates even the time we were doing like technology events. It was really like the beginning of financial planning as a profession, welcoming women, growing in that space. I think there was a lot of tech boom that happened when we first met. Swift: So I remember you had a role at FPA and we worked together on the major firm symposium, and then you came to T3 and we had a lot of crossover&And now I'm just delighted to see you working with FP Transitions and all the work that you folks are doing around benchmarking for advisors, growing and proving the value of your firm. So what's new and exciting in your world? Flynn: There's a lot of things happening. There's a lot of hype around the M&A Marketplace. Advisors today are turning to their businesses in a different way, because the last few years, the value of firms has been increasing dramatically with potentially little to minimal work on improving efficiencies or technology or staff. And now, as we're seeing things kind of bubble up to a head, the industry is looking for firms that have figured out how to crack that code and the ones that have, we can really dig into what's made that work for them and share that with others. So aside from M&A it's compensation design, entity structure, ensuring that your business is really built to endure longer than the original owner. It's about bringing in that next wave of talent and creating more sustainability. Swift: I remember being in the room at FPA Retreat recently in Austin. That was just a few short weeks ago and I attended the session one of your colleagues delivered. And one of the things I remember is that just by working with FP Transitions and using some of the tools and methodologies that your business can be more profitable now, just getting it sale-ready in the event that you need that, or you need to show value proposition. It's just a great way to run a business. Even if you have no intention, anytime soon of selling. Flynn: Absolutely. I think continuity planning we always talk about it as like the gateway to succession planning, but in reality, everyone needs a continuity plan. That's a non-negotiable. And if you go through the effort of thinking through, who's going to care for your business when you can't, it makes it a lot easier to then identify, okay, these are the skills, this is the criteria. And at the end of the day, you also need to know the value. Even if you're not anticipating a sale, you still want to make sure it's protected and can be absorbed by whoever is taking over the business, even if it's temporarily. Swift: And thinking about the next generation, I imagine that that gives them a lot of confidence, like this is a well run business. It's been valued and here's my track if I'm gonna stick with the business, here's what the future might look like. Flynn: Yes. Just to know that your owner has thought of those things and to see that is reassuring as well as, one of the number one questions we get from the next generation is, okay, I see my firm being really successful. I see what this owner has built and it's remarkable. So how can I build something similar? And at the same time, can I even afford to step into their shoes one day? And one of the things people forget, is that just because one person founded the company doesn't mean one person needs to then step into that role. It's usually multiple hats that need to be shared. And so it's a three or four person effort to actually take on that next level of ownership and grow the firm. Swift: Well, I know there are a lot of questions in the room when I saw the speaker at FPA Retreat in Austin, and you're here at the ACE Academy in the Exhibit Hall, speaking to advisors. What are some of the common questions that you hear? Flynn: I think this audience in particular, they've built such a successful firm. It's usually multifaceted. It has number of staff. It has one or two owners, and they're looking to not only create a successful future for the firm, but they also wanna diversify and potentially expand their service lines. And so they're asking questions around really smart business practices, potentially mergers maybe acquiring a line of business they don't currently offer, and then they're looking for efficiencies. And so their questions around benchmarking might be, "am I spending enough on technology or marketing?" Or "should I hire someone who is ready to learn and grow or should I bring someone on who's already a rainmaker and has successful business that they can bring with?" Swift: So thinking about the fall, I think you mentioned you're gonna be at Futureproof, NAPFA, Schwab, MDRT, maybe the Bob Veres Insiders Forum. So anybody listening to this episode can find you, or they can just go to the website and learn about all the tools and resources. Flynn: Absolutely. Thanks so much for having us. Swift: Thanks for being here. GUEST #7: RAY SCLAFANI Marie Swift: Hey, so I am back and I'm joined now by Ray Sclafani. I understand you have Sicilian roots. Tell us about that. Ray Sclafani: Oh, Sicilian. My family's from Agrigento and Palermo. My father's from the village of "Scla-thaw-knee" as they say in Sicily. Swift: Oh, man. I love that. And I was recently in Positano and it was great. Great. Yeah. What a beautiful area. I would love to go to Sicily. Next time, maybe. Sclafani: It's definitely worth the trip. Swift: Yes. But then the world changed and we got to stay home for a long time. And now we're back, we're back at conferences. Sclafani: We're back in better than ever. It's so great to see IWI. Yeah. And all the people learning and growing together and visiting in the hall here, just talking to each other. It's awesome. Swift: It is. It's so great to be here and we're in Nashville in the Music Center here. Bon Jovi is actually one of the featured artists playing over at the Amazon Conference next door to us. Sclafani: Oh, maybe that's what all the boom-boom has been. It sounds like they're practicing. Swift: And we have the Magic Fashion Show right next door, but you know, IWI has you, and you're gonna be talking later today about building business for advisors. Tell us a little bit about what you're talking about. Sclafani: Yes. So I'm running a master session this afternoon, so it's a little longer than the typical breakout session, which is awesome because we're gonna do some hands on work, break up into smaller groups. And the title of the presentation is "Amplify Your Enterprise Value Through Total Team Leadership," which means in order to scale and grow, you've gotta build an interdependent team. It's what the clients are looking for. And it's not as easy in a world where we see the Great Resignation and the race for talent, which is the greatest threat in financial service. Swift: Yeah, it sure is. So you've also written this book and I'm holding one in my hand: "You've Been Framed: How to Reframe Your Wealth Management Business and Renew Client Relationships." And I know your organization is known for coaching advisors and just really helping them to develop a different level of success. So maybe tell us a little bit about your book and your coaching program. Sclafani: Sure. The advisors we coach are high performers who deeply care about the impact they're having in the lives of others and are committed to building multi-generational businesses and enduring firms. In order to do so, most don't start out in this profession with a large team and a multi-generational firm. They start oftentimes as solo. Or Lone Rangers, and they kind of acquire all the skills they need: relational and technical and leadership along the way. And so what we do is help advisors think about how to reframe the business for the future. About every 36 months, we learned in the research of interviewing over 3,000 advisors, that the best in the business spend time communicating to clients and prospective clients and professional advocates and loyal client advocates, their message. And their message is always evolving and changing and improving and growing and the credentials they're acquiring and the team they're building out. And so that concept of 'enduring firm' requires a reframe. It requires a constant improvement and focus in on that. So we've built cohort groups in our business builders academy to help advisors work together and learn from one another. But also learn from our coaching team at Client Wise as well. So that's very much what the book is about. It's really the centerpiece of how we help advisors grow. Swift: And I'm gonna start with chapter four, which is the "Big Fat Lie," right? Sclafani: It's my favorite chapter. Swift: What is the big fat lie? Sclafani: Yes, so, you know, one of the things we learned along the way is, the clients who are looking for a relationship with their advisor, it isn't just for a period of time. In fact, what we learned advisors say to us either implied or explicitly to the client, "Hey, I'll be here for you through life transitions." Well, if you're acting as a fiduciary, you've got to seriously consider, are you spelling that with a capital F or a little f? I mean, do you have a plan to serve clients multi-generationally? Do you have a plan in the event of disability or death, or heck, a desire to retire, to serve those clients? Are you preparing heirs? Are you working with their children and their grandchildren? And so this concept of the big fat lie is, "Hey, I care about you deeply... well until I'm not here." And that isn't really what advisors are about. But when we look at this industry with the average age bumping up above 58 years of age, and according to Fidelity, according to Barron's, you know, all of the data sources we look at, some 78% or so of advisors don't have a named successor. They're not really thinking about who's gonna care for their clients in the event that they're not caring for their clients. So I think we've got some work to do as an industry. And we have a transformation because financial services is a noble profession and if it's gonna remain noble, then we've gotta prepare teams in order to carry on when the advisors are no longer. Swift: So smart, so smart. And we were talking before we jumped on the podcast about your Business Builders Academy and you have those what? Every 90 days in Dallas? Sclafani: Yes, so we we've learned along the way. My friends at Strategic Coach, Dan Sullivan and Babs -- I was a Strategic Coach client for 17 years. So as Dan would say, I'm a slow learner with cash. But I really admired ... Dan was the one that kind of pushed me out and said, "you ought to go build a coaching firm for financial advisors." So. 20 years in working in the asset management business for a large firm, I decided to be an entrepreneur and start a company. And one of the very first things we did was launch our Business Builders Academy. We bring groups of 20 to 30 advisors together, in person every 90 days. We had, pre-pandemic, 16 locations across the US and Canada. And the workshops are amazing. Advisors interact and share with each other, always learning and growing. We've got a curriculum, a five year curriculum. We're always developing new curriculum. So there's a long learning cycle and a chance to build a great network of peers with which to learn from. Post-pandemic, we reopened in Dallas, so we're having everybody come to Dallas and we also created a virtual series as well. So for advisors not yet ready to travel, or don't wanna travel they have an opportunity to participate virtually. Swift: Wow, fantastic. Well, I wanna go to Sicily. I also wanna go to Dallas to one of your Business Builder Academies. Sclafani: Let's go to Sicily first, Marie, that sounds like a lot more fun. Swift: I'm in. Well, thank you so much for being here, Ray. GUEST #8: MARK PAULSON Marie Swift: All right. I am here at the ACE Academy in Nashville. And I'm joined now by Mark Paulson with Allianz Life Insurance of North America and I'm looking at your banner over there. It says "long live retirement." Mark Paulson: Yes, absolutely. We're one of the best in the industry at providing retirement income for our policyholders. Swift: And people are living longer than ever, and things are a bit uncertain. So I know that there's a lot of peace of mind that advisors can provide their clients by using some of the Allianz solutions. So talk to me a little bit about your role at Allianz and what you spoke about yesterday here at the ACE Academy. Paulson: So I'm the Vice President of Global Hedging within Allianz's Investment Management. Part of that role is in, you know, obviously hedging the index interest credits inside of our products. Another part of it is really educating clients and advisors on how to use these products in their client's portfolios. So we've recently published a white paper in the Retirement Management Journal. That's published by Investments & Wealth Institute. The title of the paper is "Controllable Factors and Uncontrollable Risks in a Retirement Spending Plan." We kind of broke down the things that an advisor and client have some control over. And then some of the risks that their portfolio might be exposed to after they've controlled for some of the factors that they can, that they have some control over. Swift: Yes, it's a topsy turvy world. You live in Minneapolis and the weather has been a bit topsy turvy. Paulson: It has been, it's been a pretty ugly spring. April pretty nasty. We've turned the corner, I think. And May so far has been looking pretty good. Swift: All right. Well, thank you for being here. Paulson: Thanks for having me. GUEST #9: TIM WHITING Marie Swift: Okay. So our final conversation today is with Tim Whiting. He is the Chief Revenue Officer for the IWI, the Investments & Wealth Institute. And Tim, its so great to be back in person. Isn't it? Tim Whiting: It's awesome, Marie, and it's so great to see you and thank you for being here. Being here with the podcasting and the Digital Hive. I think it's a neat new feature for this conference. And we'll be in San Diego next year. Just take a look at the date here, but we'd love to have this type of setup in San Diego as well, because I just, I think it's wonderful way for advisors to learn some new technology, which has changed so much. But the ACE Academy 2023 will be in San Diego, April 30th through May 3rd. And we're looking forward to having another great crowd now that we're back in person. Swift: I've loved being in the Digital Hive here. It's an "experiential learning center" because we hope attendees will just come by, see our equipment, maybe shoot a SocialCam video with us. We're inviting some people to be on the podcast, but you know, we can all up our digital game, right? We can all get better with our devices. Whiting: Oh, absolutely. And when you look at some of the different places that are talking about how you communicate and engage with people, video is just on fire. We've been doing a lot more in the video scene. I think COVID really ramped that up with us not being able to be in person and doing a lot of things with... we moved our whole ACE Conference, we called it ACE Academy and we did it all virtually, all online. And I think that really upped our game in terms of videotaping and understanding how people learn. And they're gonna continue to learn that way. There's gonna be a hybrid effect from this. There's some people that love to be in person. Like this, there's nothing like being in person, but you know what? If you're not able to travel for whatever reason, and that's your choice, we're also videotaping sessions and making them on demand after the fact. So in this world today, you could really consume content however you'd like it, in person or online. And we've really moved quickly into a hybrid learning environment. Swift: So the Institute does a great job with all of the educational components and some very sophisticated subject matter expertise and experts. So I think that making and engaging is really important, especially if it's gonna be virtual. I'm thinking too,, about the advisors, the practitioners here, who are attending, or maybe they're just hearing this podcast that they can create their own celebrity effect, really. If they're more present in their clients and their centers of influence life, just by doing authentic video on their iPhone or with their webcam or starting a podcast. Let's talk about "celebritizing yourself." Everybody wants to be slightly famous or to work with somebody who's slightly famous. Whiting: And I think what's exciting too, it didn't launch at this conference, but we'll be launching soon. We have a new advisor search tool called InvestmentHelp.org. And actually at this event, we've got a booth set up with a professional photographer to take head shots, and people really need to personify themselves. This is a people business. This is a trust business. You need to build trust with folks. And one of the best ways to do that is to show who you are, right? It's not just a list or a name. What we created was the search tool with folks' pictures, the little bit about them, the services they provide. A little bit about their psychographics, about maybe they speak multiple languages or enjoy tennis or golf, and then they can upload videos, accolades, that type of thing. And so we hope to have that launch before the end of 2022. What's neat about it, there's an algorithm in there, too, that will match consumer investors with the right type of advisor. And unlike some other tools out there, this is really built for the investor. We are not asking for their phone number, cell phone number, email address. They can go through the tool and be served a list of advisors that would suit their needs to make it simpler for them to find a CIMA, a CPWA or an RMA, and even a CFP if they're part of our member base. And so we think this is a game changer. And a really different way to... it's okay for major firms to have listings of their advisors, but it's really only listing their firms. And we're a multichannel organization serving wirehouses, independents, RIAs, bank channel. And this is a great way for investors to find the right kind of advisor and that's a service then that the Institute can provide. Swift: So, I know you also had your board meeting here and just a great curriculum with CE and it's just a really robust agenda. But I know you also had a big announcement here about the Foundation, and maybe you could just close with talking about the scholarship fund and the Foundation. Whiting: Yes, a few years ago, our board realized that our certifications are delivered through Ivy League quality providers. So we have Wharton, University of Chicago, Booth, and Yale. I joke that we're the discount brokerage for executive education, because while our certifications seem expensive, if you look at the executive education that Yale and Booth and Wharton provide it's expensive, you know, $15,000-20,000. And so our certifications range -- at least the CPWA and CIMA -- between about $5,000 and $7,300. Which is still a significant investment of money and time for individuals. So one of the things the board did was provide some seed money to create a scholarship fund, to reduce that barrier. And we identified folks that in the industry that are underserved. So, women, people of color, nextgen, whatever the case. And we made this scholarship up to $2,000 available. And it's been a great success for now the past two years. So then folks said, "well, what's the next step from that?" We're a 501(c)(6), but we needed a 501(c)(3) in order to take tax deductible contributions. So we've filed with the IRS for our C3. And we've announced the formation of this new foundation. It's the Investments & Wealth Foundation. Kevin Sanchez, who is a UBS Institutional Advisor, prior IWI board chair, and a great volunteer. He's gonna be heading that up and we're just excited because now we have the opportunity to take donations from our members, firms that serve the industry, or just folks that want to make a difference and, and try to help educate the marketplace. We were back talking earlier about how many firms now are focusing on DE&I, and I think one of the challenges that they have is that the pool of qualified candidates is not particularly diverse. So by removing a price barrier, by focusing in on these groups and giving them an opportunity to get knowledge and earn our certifications helps broaden the diversity of the talent pool. And then that ultimately that's how we can really make a difference in changing the face of our industry. Swift: I know I'm gonna be speaking a little while to someone from Thrivent Advisor Network, I think is what the full name is... they're going to make a donation. Whiting: Kelly Caffrey, who's an old friend who was in the industry for many years and she left the business for a while because her firm (TD Ameritrade Institutional) was was acquired and she's back in as Chief Marketing Officer at TAN. And I just think it's brilliant what they did instead of having tchotchkies that they give out here at the conference, they're making a donation to the Foundation. So, we love to see that kind of. And that, that type of partnership from the organizations that support us. Swift: That's fantastic. Well, I noticed that the buzz in the exhibit hall has just gone up and I know we have a robust crowd here, but there's the Magic Fashion Show down the hallway, too. Whiting: We do. And I know you have a ton of folks to speak, too. I know we have Amazon on the one side and the Fashion Show on the other side of us. Swift: Bon Jovi is in there, rehearsing, I think. Whiting: We've heard the loud noise of Bon Jovi next door. We did have some acoustic players come in for the evening reception last night, and Nashville is a fun city so people will go out and about tonight - Printer's Alley and all that. And like I said, we're in San Diego next year, which is also a, a beautiful city, a great destination. If you haven't been to the Gas Lamp District, I'd encourage you to come out to San Diego next year for our ACE Academy. Swift: Sounds great. Thanks so much, Tim. Whiting: Thanks, Marie. Appreciate it. Comments are closed.

|

About

|

|

Stay Connected

|

Phone: 913-649-5009

©2023 Impact Communications, Inc.

|