Do you feel called to a greater purpose? Is there something you, like me, feel you were born to do, something that would make a positive impact on those around you?

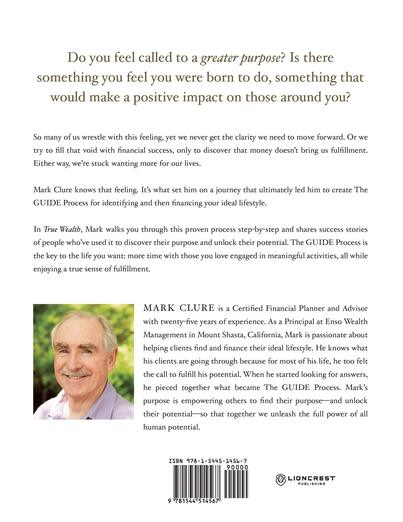

So many of us wrestle with this feeling, yet we never get the clarity we need to move forward. Or we try to fill that void with financial success, only to discover that money doesn’t bring us fulfillment. Either way, we’re stuck wanting more for our lives. Mark Clure, CFP®, knows that feeling. It’s what set him on a journey that ultimately led him to create The GUIDE Process for identifying and then financing your ideal lifestyle. I asked Mark to visit with me via a video conference service and have included both the transcript and the video recording of our Swift Chat below.

Mark Clure, CFP®, is a fiduciary financial advisor with twenty-five years of experience. As a Principal at Enso Wealth Management in Mount Shasta, California, Clure is passionate about helping clients find and finance their ideal lifestyle. He knows what his clients are going through because for most of his life, he too felt the call to fulfill his potential. When he started looking for answers, he pieced together what became The GUIDE Process. His purpose is empowering others to find their purpose—and unlock their potential—so that together we unleash the full power of all human potential.

Enso Wealth was recently recognized by Financial Times as one of this year’s top 300 Registered Investment Advisors in the US. Swift Chat with Mark Clure, CFP®

|

About

|

|

Stay Connected

|

Phone: 913-649-5009

©2023 Impact Communications, Inc.

|